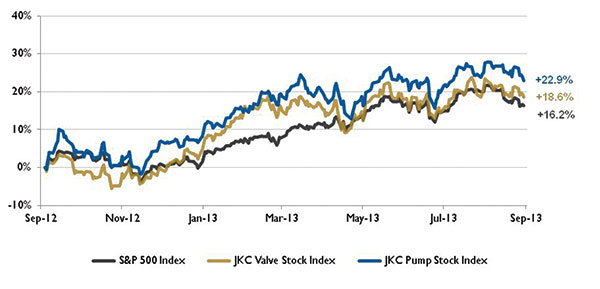

The Jordan, Knauff & Company (JKC) Valve Stock Index was up 18.6 percent over the last 12 months, above the broader S&P 500 Index which was up 16.2 percent. The JKC Pump Stock Index was up 22.9 percent for the same time period.1

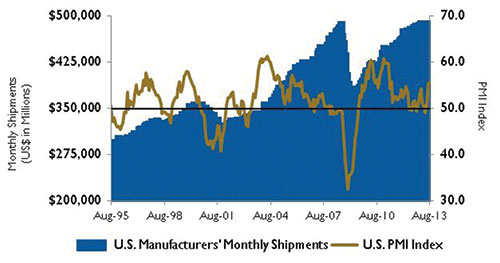

The Institute for Supply Management’s Purchasing Managers’ Index (PMI) registered 55.7 percent in August, its highest reading since June 2011. The New Orders Index increased by 4.9 percentage points to 63.2 percent and has risen steadily since a May 2013. Comments from the companies surveyed ranged from slow to improving business conditions depending upon the industry.

The JPMorgan Global Manufacturing PMI rose slightly in August to 51.7 percent from July’s 50.8, showing overall growth in global manufacturing for the eighth consecutive month. Production rose for the tenth month in a row, while the rate of new order growth rose to a 30-month high. The rate of increase in manufacturing output climbed to its highest since 1994 in the U.K. and hit a two-and-a-half year high in Japan. However, broad-based weakness was reported in a number of emerging markets including India, Taiwan, South Korea, Indonesia, Vietnam and Brazil.

The Bureau of Economic Analysis revised the U.S. gross domestic product (GDP) annual growth rate for the second quarter of 2013 to 2.5 percent from its earlier estimate of 1.7 percent. The revision was primarily the result of rising exports, consumer spending and real estate spending. The GDP growth rate was 1.1 percent in the first quarter, 2013. All economic news is being carefully watched for signs of when the Federal Reserve will begin slowing its bond buying program.

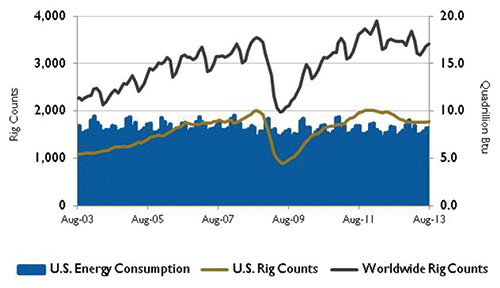

An increase in unplanned liquid fuels production disruptions in August combined with peak summer demand and rising concerns over the conflict in Syria and its regional implications, contributed to a tighter world oil market during the month. Unplanned disruptions reached an estimated 2.7 million barrels per day in August, the highest level since January 2011. OPEC producers accounted for 2.1 million barrels per day of these outages, the highest level since at least January 2009 when the Energy Information Administration (EIA) began tracking this information.

On Wall Street, August was a turbulent month because of concerns regarding the Federal Reserve’s plans to cut back on monthly bond purchases. The Dow Jones Industrial Average lost 4.4 percent but is up 13 percent for the year. The S&P 500 Index was down 3.1 percent for August but is up 14.5 percent for the year. The technology focused NASDAQ Composite Index lost only 1 percent during the month and is up 19 percent for the year.

Reference

1. The S&P Return figures are provided by Capital IQ.