As the demand for flexibility and efficiency, along with a growing emphasis on environmental awareness, continues to rise in significance, it is increasingly necessary for operators to concentrate on pumps and pump installations.

When looking into the future of hydrocarbon production, various scenarios and predictions can be observed. Nearly all these developments hold substantial implications for the oil and gas industry and influence current planning for the future. These consequences extend not only to the oil and gas producers, but also to equipment and service suppliers, including pump manufacturers.

In all the development scenarios for future oil and gas production, it is anticipated the primary focus will remain on efficiency, conservation and minimizing environmental impact. Already, the industry’s attention is shifting rapidly toward these targets. The more efficiently the industry can adapt to these changes, the better prepared everyone will be.

This article explores current trends in pumps in the oil and gas industry and uses a combination of present knowledge and future scenarios to paint a picture of what needs to be addressed today to be ready for tomorrow.

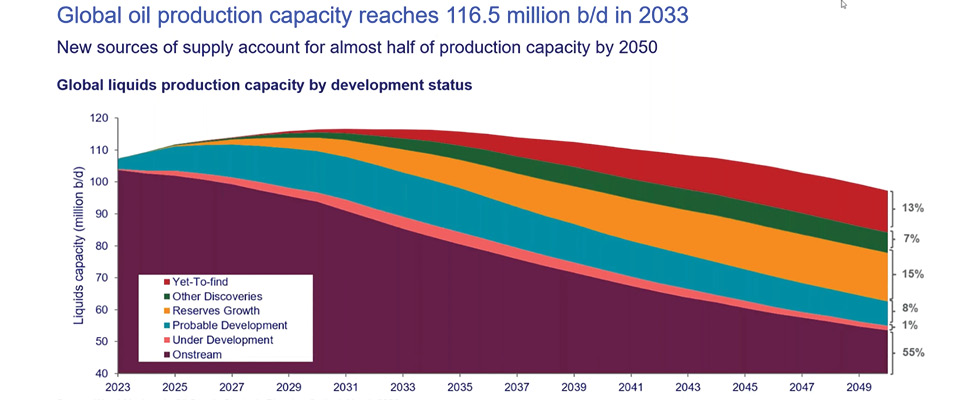

In a recent oil field technology webinar from a global research and consultancy group, outlooks were provided for the oil and pump industries. One notable highlight from the presentation was a glimpse into oil and gas production in the next two and a half decades. It indicated peak oil production is expected to occur around 2030, with a production of approximately 115 million barrels per day (BPD) tapering down to around 90 million BPD by 2050, compared to just over 100 million BPD today.

This means oil production is projected to remain close to current levels, based on West Texas Intermediate (WTI) oil prices fluctuating between $60 and $80 per barrel. These predictions are in alignment with International Energy Agency (IEA) forecasts and indicate a less significant decline than initially expected. The main factors contributing to these projections include uncertainty surrounding energy transition supply capability and available capacity, the increasing use of plastics and oil derivatives, a growing petrochemical industry in the developing world (including India and China) and the rising demand for jet fuel, which is expected to peak in 2040.

Even with the expected substantial increase in electric vehicle (EV) use, these vehicles are not anticipated to represent more than 20% of the world’s vehicle stock by 2030.

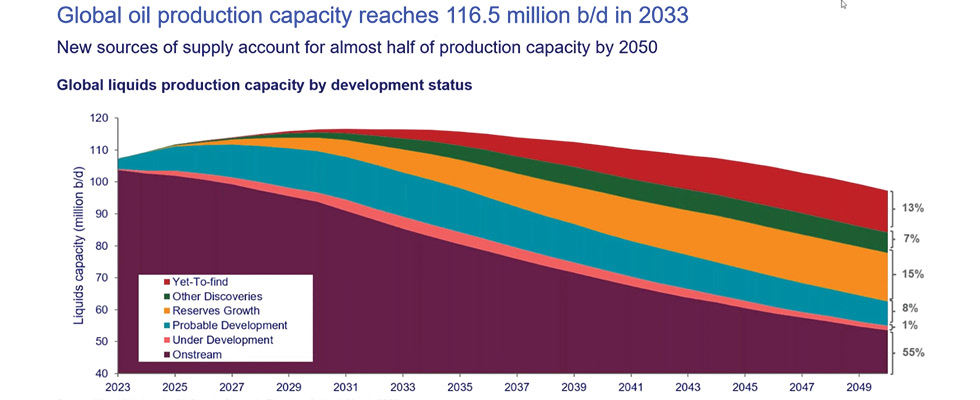

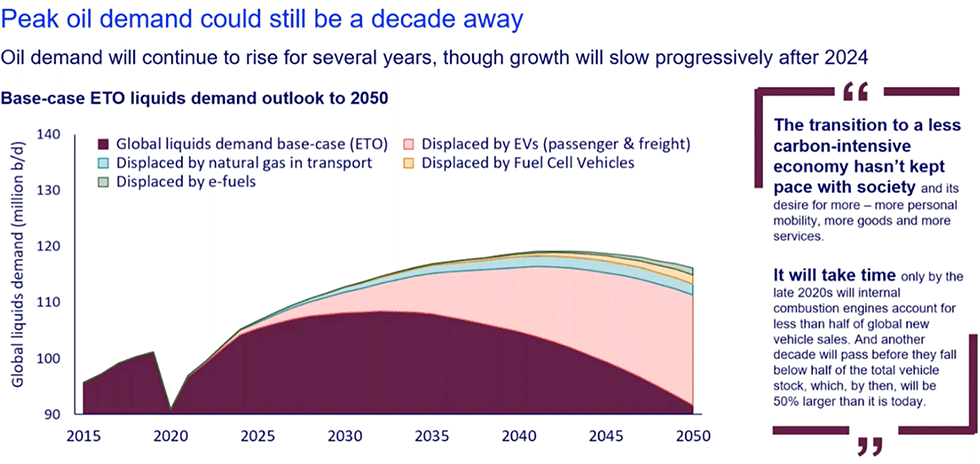

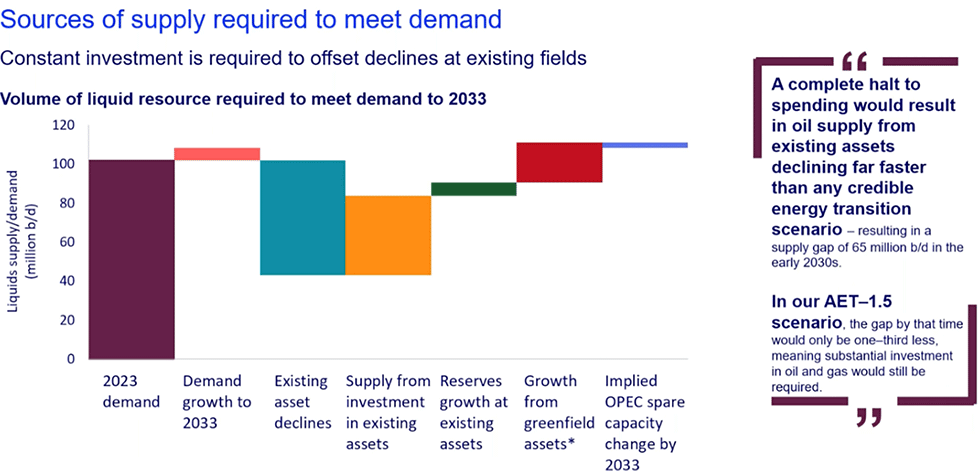

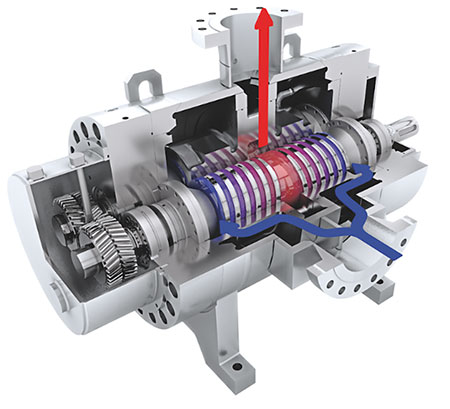

In a crucial segment of the webinar, the discussion centered on how to meet the expected oil demand. The presentation revealed 15% of all production will come from extended production in existing reservoirs (Image 1). It also illustrated the major impact the transition to EVs will have by the middle of the century (Image 2).

As shown in Image 1, 15% of all production will come from extended production in today’s existing reservoirs. Image 2 shows how peak oil demand keeps being pushed further into the future and Image 3 shows how the demand is expected to be met.

Increasing supply from existing assets is becoming increasingly important and is high on the agenda for most producers. This has led to a growing demand for pumps and pumping solutions. As aging oil fields come with declining natural pressure, flow assurance challenges and often outdated and inefficient equipment, new pump applications are emerging. Examples include the growing demand for pumps to support artificial lift and boosting flow pipe surface flow lines. Other examples include pumps for carbon dioxide (CO2), which will see increased demand as CO2 sequestration and enhanced oil recovery (IOR) become more frequent. Many types of pumps will experience growing demand due to the evolving nature of oil production and as replacements for inefficient or outdated models. Additionally, the growth in pipeline transportation of crude oil and refined products to processing facilities, terminals and refineries is generating increased demand for pumps.

Pumps are traditionally categorized as either hydrodynamic or positive displacement style pumps. These two types of pumps have both distinct and complementary uses in oil and gas production and hydrocarbon processing. Hydrodynamic pumps are primarily used to handle lighter fractions and water at higher flow rates, while positive displacement pumps serve more viscous and gas-entrained liquids at higher pressures, often under challenging suction conditions.

This article will focus on the increasing use of rotary screw pumps, which are recognized as rotary positive displacement pumps. Many of the insights may also apply to gear pumps, vane pumps and progressing cavity pumps, though they may not directly overlap with screw pumps in many applications. There is already a growing use of positive displacement pumps, including screw pumps, that are performing a wider range of services, enabling enhanced oil and gas production, gathering and processing of hydrocarbons, and addressing increasingly challenging flow assurance conditions as reservoirs age and field-life extensions become a priority.

The oil and gas industry will face more challenges in producing, transporting and processing oil and gas due to increasing product demand and the need for efficient capital utilization, operational flexibility, revenue, performance, improved energy efficiency and meeting environmental and societal demands. For many reasons, screw pumps have started to play a more significant role in applications that have traditionally been dominated by centrifugal and reciprocating pumps. Screw pump manufacturers, driven by technological innovations and product improvements, are stepping up to meet the demands of the oil industry with more efficient and flexible designs.

In many oil fields, screw pump designs have demonstrated their advantages and become increasingly common. This is especially evident when the industry seeks to extend production from existing assets and facilities. Achieving higher recovery from aging and more challenging assets, often characterized by higher viscosity, oil-water emulsions, more associated gas and lower reservoir pressure, presents common challenges. These challenges are all part of late-life production, and screw pumps typically offer the best pumping solution in such scenarios.

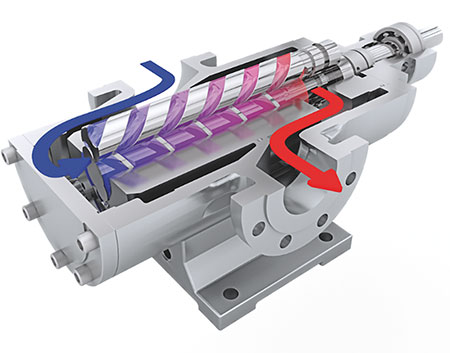

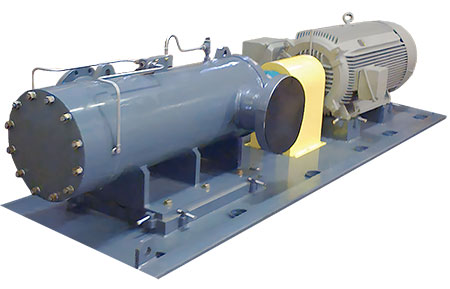

Both twin-screw (Image 4 and Image 5) and three-screw (Image 6 and Image 7) pumps are used for these applications. In midstream applications, they are used as transfer and booster pumps in pipelines and terminals and for gathering and boosting, including multiphase pumping for artificial lift support and wet gas production. In heavy crude and bitumen emulsion transfer, screw pumps are often the only viable pumping solution.

An increasing number of screw pumps are serving as multiphase pumps and are effectively applied as supplements to conventional artificial lift systems, such as sucker rod pumps (SRPs), electrical submersible pumps (ESPs), gas lifts and plungers. The most significant benefits are the reduction of the conventional facility footprint, elimination of flaring and reduced greenhouse gas (GHG) emissions through the combination of oil and gas in a single multiphase pipeline for transport to the processing facility. In shale production, the typical rapid decline in natural reservoir pressure and increased associated gas production necessitate solutions to maximize production and delay increasingly expensive workovers or new drilling, fracking and completions. The desire to extend recovery and leave minimal hydrocarbons behind necessitates a flexible multiphase pumping system, as shown in Image 8, that can operate with low reservoir pressures. At the same time, multiphase pumping contributes to reduced environmental impact from oil production and can alleviate public opinions on flaring and venting.

The multiphase pump delivers a practically constant flow at a given speed, mostly independent of backpressure. By adjusting the pump speed, it can vary both the flow rate and the suction pressure. Lowering the pressure allows for the smooth flow of a pipeline, reducing the risk of frequent hydrate blockages and aiding in lowering the wellhead pressure to facilitate the flow of liquid-loaded gas wells. Additionally, it effectively manages paraffin build-up and oil/water emulsions, reducing the need for costly chemical injections and well treatments. This is achieved through the maintenance of low internal velocity, which limits shearing issues and avoids exacerbating oil/water emulsions, making downstream process treatment easier.

Image 9 demonstrates how multiphase pumping is utilized in offshore oil production, where it can act as a substitute for and add value to artificial lift methods, ultimately extending the life of reservoirs.

With the present state of the pump industry serving the oil and gas market, it is necessary to observe important factors impacting future success. One such factor continues to be the difficulty of finding and retaining a skilled engineering and project labor pool. These challenges are often the same for both the end user/oil producer and supplier/pump manufacturer. It may require the pump supplier to assume a larger scope of work than in the past. A complete pump module or system with all auxiliaries and controls is often required and can be a stretch for a supplier with limited resources. The “black box” concept is not new but will play a much bigger role in the future. The talent pool is much more important and will govern the success of each pump supplier.

Understanding trends and socio-economic factors is important, and adapting to the new realities is a good strategy in a fast-moving environment. It puts more emphasis on the selection of the best suitable pump for the application, relying even more heavily on the pump manufacturer.

The operational flexibility, higher efficiency and robustness of modern screw pump designs have made them ideal candidates for an increasing number of applications in the upstream and midstream markets. A strong driver is the desire by oil and gas producers to adapt quickly to rapidly shifting trends, take advantage of available opportunities for different oil and gas products and monetize these opportunities by incorporating flexible screw pump technology into more processes.