The Jordan, Knauff & Company (JKC) Valve Stock Index was up 11.0 percent over the last 12 months, slightly below the broader S&P 500 Index which was up 14.8 percent. The JKC Pump Stock Index continued its upward trend, ahead 36.8 percent for the same time period.

The U.S. manufacturing sector barely expanded in July as the Purchasing Managers Index fell to 50.9 percent from 55.3 percent in June. Details of the report, including a decline in orders and slower hiring, suggest the economy got off to a disappointing third quarter start. The only areas of good news were a slight increase in exports and an indication that energy and raw material costs are easing. The global manufacturing sector also continued to cool as the JPMorgan Global Manufacturing PMI fell to 50.6 percent, its lowest level since July 2009.

Figure 1. Stock Indices from August 2010 to July 2011

The Bureau of Labor Statistics reported that overall nonfarm payrolls increased by 117,000 in July, which was better than expected, and the unemployment rate dropped to 9.1 percent. Private sector jobs were up 154,000, with manufacturers hiring an additional 24,000 workers. Within manufacturing, durable goods accounted for 23,000 of the net new employment, led by a healthy increase in workers at motor vehicle assembly plants. Weak job May and June reports were revised upward.

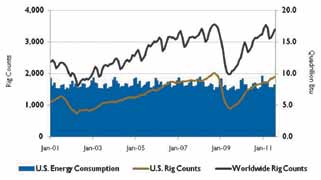

Figure 2. U.S. Energy Consumption and Rig Counts

West Texas Intermediate crude oil spot prices fell from April's average of $110 per barrel to $97 per barrel in July. During the first week of August, world crude oil prices fell by about $10 per barrel reflecting concerns about world economic and oil demand growth. However, the U.S. Energy Information Administration still expects oil markets to tighten as emerging economies' liquid fuel demands grow, outpacing supply growth.

In the first week of August, Standard & Poor's lowered its rating for long-term debt issued by the U.S. Treasury from AAA to AA+. The rating agency believes that Washington has not done enough to reduce the long-term deficit and doubts political leaders' ability to work together to solve the problem.

Figure 3. U.S. PMI Index and Manufacturing Shipments

In its latest monetary policy statement, the Federal Reserve left key interest rates unchanged, saying that deterioration in the labor market and slower-than-expected economic growth will require the central bank to keep rates “exceptionally low” until the middle of 2013. Many economists had predicted that rates would go up later this year. The Federal Reserve's decision reflects the general weaknesses in the economy and the need to keep rates lower to stimulate growth.

On Wall Street, investor sentiment has been shaken by recent U.S. events and concerns regarding European economies and the impact on world markets if another nation were to need a bailout.

These materials were prepared for informational purposes from sources that are believed to be reliable but which could change without notice. Jordan, Knauff & Company and Pumps & Systems shall not in any way be liable for claims relating to these materials and makes no warranties, express or implied, or representations as to their accuracy or completeness or for errors or omissions contained herein. This information is not intended to be construed as tax, legal or investment advice. These materials do not constitute an offer to buy or sell any financial security or participate in any investment offering or deployment of capital.

Source: Capital IQ and JKC research. Local currency converted to USD using historical spot rates. The JKC Pump and Valve Stock Indices include a select list of publicly-traded companies involved in the pump and valve industries weighted by market capitalization.

Source: U.S. Energy Information Administration and Baker Hughes Inc.

Source: Institute for Supply Management Manufacturing Report on Business® and U.S. Census Bureau.

Pumps & Systems, September 2011